Introduction

Two of our Samuel & Co Trading Algorithms have been performing exceptionally well, outperforming the market over the last 2+ years. With over a +300% gain for both Fusion and BeastMode combined, whilst maintaining a consistent risk management protocol, the unbelievable returns have only just begun.

What you may not know is that a small hedge fund, based in New York, has managed to generate over 223% in the first half of 2022. Much like our algorithms, these returns have taken the markets by storm. In this report, I will be discussing the firms’ background, strategy, and trading history to show how anyone can be hyper-successful in the financial markets, to achieve outrageous returns.

Overview

The hedge fund I am referring to is known as Coltrane Asset Management. They have been gaining widespread attention across major financial news outlets due to their performance in 2022 alone – and we are only just halfway through the year.

The fund is based in New York, founded in 2012, and manages $1.92 billion in assets under management (AUM).

Fund History

The Managing Partner is Mandeep Manku, a 38-year-old who grew up from humble beginnings in the north of England. He developed an early interest in stock markets and valuation models. During high school, he was active on internet forums and message boards dedicated to stock analysis. He opened a brokerage account in his mother’s name and started to invest for himself with his friends. He went on to study at the London School of Economics as a teenager, before founding Coltrane with another partner.

This is important as it proves that anyone can study their craft, develop their system, and rise to the top to earn hundreds of millions of dollars, no matter the starting point.

Trade Ideas

Now we can break down the positions that lead them to these incredible returns.

Coltrane Asset Management noticed how overextended the market was. Manku decided to change from ‘Cheap European’ stocks to overvalued big tech. The idea was proposed after many of these US companies were trading at 10x their revenues – exceeding what would be considered a reasonable valuation. Towards the end of 2020, the firm started to load up on put options, betting big tech would fall despite the recovery rally from March 2020 COVID lows.

As many of you may know, the continued stimulus from central banks saw huge stock market runs through 2021, leaving Coltrane hundreds of $ millions in drawdown. This led to huge amounts of pressure on the firm to close these positions and take the loss. Certain of a price drop, Manku maintained his stance.

Clients were demanding answers and requesting to withdraw funds. The partners conveyed to clients that the hyper-growth of some of these companies could not continue. As the Fed reduces asset purchase programs through quantitative easing, the market could not justify current overvaluations.

Positions

We know that the fund positioned itself mainly with put options, betting that the prices of the following companies will go down. However, we do not know the exact details of these options.

What I will do instead is show the prices of each stock around the time they started placing the positions and show the current price.

Here are some of the companies CAM bet against:

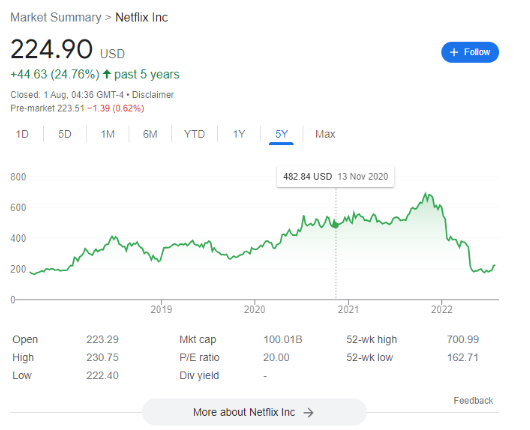

Netflix

Netflix has had an interesting year. From holding a total valuation (market cap) of around $300bn, it has fallen over 50% in just this year alone. The increased monthly subscription has seen users boycott the hikes, in favor of other streaming services.

As you can see from the screenshot below, the share price of Netflix has plummeted from highs of just under $700 in October 2021:

When Coltrane started to load up on short positions, the share price was ranging around $450-500, depending on the dates they entered and the prices available. Therefore, the firm was in considerable drawdown for around 15 months!

If you had millions of dollars in client funds and were in drawdown for that amount of time, would you be able to sit on your hands and stick to your analysis?

Peloton

The next position CAM held was against Peloton. This was one of their most successful positions as they caught the move right at the highs. At the time, Peloton was performing extremely well. Earnings were through the roof as customers moved to home fitness during the lockdown period.

It was in the month after, December 2020 that Peloton saw its highs, not returning to these levels. Moving from over $160 per share to now just under $10 is a mega-trade! And as mentioned, using options made the position even more fruitful.

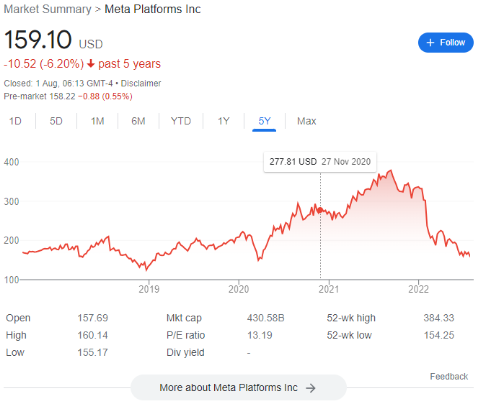

Meta Platforms

For Meta, the company has had a volatile climate over the last 2 years. The public scrutiny has enhanced the overvalued big tech stance. The share price climbed following the entry period to just under $400 per share in September 2021. Since then the stock has fallen off a cliff to lows last seen in the initial COVID market drop.

The company, regardless of public scrutiny still has a huge user base and engagement so could see a price recovery. For now, it is unclear on the direction of this enormous company.

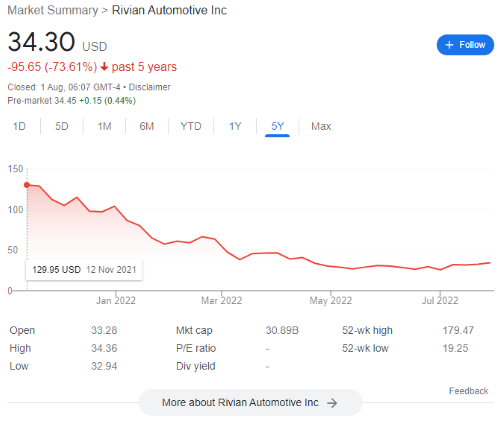

Rivian

Rivian Automotive is a US electric vehicle manufacturer. The company saw a record-breaking valuation during its Initial Public Offering (IPO) in November 2021. This was due to its ties with Amazon, which have ownership in Rivian and likely to order a mass-produced truck to improve logistics for their supply chains and delivery service.

The market reaction to the expected first order of around 10,000 vehicles would see revenues skyrocket, giving the company a valuation of over $100bn. Since the IPO, the price has been steadily dropping from the highs of $130 to now sitting around $30 per share.

The company still has a giant valuation at just under $30bn. It could still see further downside, especially if a recession is confirmed.

Coltrane could have only started loading up on positions in November 2021. For just under a year, the position has seen little upside momentum from the initial release – giving the position little drawdown, with high returns in a relatively short amount of time.

Carvana

Their most profitable trade was against the used-car website, Carvana. The company dropped over 90% in just this year alone. The stock went parabolic from March 2020, hitting over $360 per share.

In an Initial Public Offering (IPO) of 2017, the company ranged between $20-100 for around 3 years. It was only after the March 2020 sell-off, with lows around $30, that the price rebounded on an explosive move to August 2021 highs of $360 per share.

It is unclear where Coltrane entered their positions. If they started in November 2020 when they first decided to load up on short positions, the share price was around $200.

Wherever they started purchasing put options on Carvana, the position was a considerable one. The 90% drop in price from the highs, lead to a 9% return on the year alone.

Options

Now, I do not personally trade with options. There are plenty of market participants who are more knowledgeable in the market that you can learn about options from. I will instead outline the benefits of options and why many hedge funds like Coltrane, place options instead of trading CFD’s / Spreadbetting – or purchasing physical shares.

Options are a financial product where you have the right, (but are not obligated), to buy or sell an asset at a pre-agreed price and date. A call option is where you are looking to buy the stock, and a put option is where you are looking to sell it.

This means that an individual or fund can place a position based upon the ability to buy or sell a stock at a more favourable price if it is traded to.

The reason this is beneficial to both retail and institutional investors is due to the reduced risk associated. They require less capital commitment upfront rather than owning physical shares, or the margin required to trade on CFD’s / Spreadbetting.

Because of this, options allow for higher returns due to the enhanced leverage of small upfront capital requirements. If an investor is expecting a price by a time period, then they can purchase a wide variety of options to generate enormous returns if correct.

But that is the downside with options. You are betting on a price within a time period. If you do not see that price, which can happen often as the market is extremely unpredictable, you can lose the investment – rather than holding the shares and staying patient for it to rise/fall.

Therefore, options are often regarded only for specific situations and market conditions. Many beginner-amateur investors may find options extremely difficult. It seems that only the most experienced individuals/hedge funds use options for mega returns.

Lessons

I have written this report for the valuable insights and lessons that can be learned from this amazing achievement. Coltrane Asset Management is a perfect example of a hedge fund showing an ability to pivot from one strategy to another. The initial strategy of ‘cheap’ European companies, to betting against big tech has given the fund incredible returns in a short period of time.

The strategy of betting against large ‘overvalued’ companies can be exceptionally risky. I would not recommend going short regularly as markets over time generally go up. Big tech has seen unstoppable momentum until now. It shows that when the market conditions align with the fundamental driving forces behind the overall sentiment, extremely profitable opportunities can be found on either side of the market.

As that familiar saying goes; ‘you can make money in a bull market, but bear markets can make you rich.’

This is why I have loaded up on the companies I have. I am betting that my portfolio of undervalued companies with strong track records will recover beyond their fair value, yielding high percentage returns.

Here is a link to the report outlining one of my portfolios, with a breakdown of each individual position.

Conclusion

I also wanted to bring this recent release to your attention as it shows that anything really is possible in the financial markets. If you look at Mandeep Manku, Managing Partner of Coltrane, you can see that anyone can go from humble beginnings to earning hundreds of millions of dollars for the fund in a short period of time.

The ability to go against the market, with an idea that had a high probability of success as the Fed reduced its quantitative easing, is an extremely valuable lesson to be learned. Then the patience and nerve to be in a deep drawdown of around 80% of total capital, but still hold on is even more impressive. Would you be able to do that?

Remember, we want to be in the game long enough to capitalise on once-in-a-lifetime opportunities like this.

Useful Links:

Coltrane Asset Management, L.P. (New York)

One Hedge Fund Is Up 223% This Year Thanks to a Big Bet Against Tech Stocks