In this stock report, I am going to be breaking down a potential trade opportunity that the market is yet to react to. I will also be providing two trade ideas with differing risk tolerance and potential returns.

Now, I want to state in advance that in a Medium.com article I wrote at the end of last year (link at the end), I discussed how Oil was likely to hit $100 per barrel in a short period of time. I broke down the levels ahead of time and gave reasons why this was likely to happen. It was important at the time because $100 per barrel was unheard of at the time, with many believing we could never get to that point. Now we are here, I am going to be breaking down where we are likely to be headed next.

The basic overview of the trade idea is around shorting Oil. We have seen a huge price rally, to where we are now sitting at global extremes. Based on multiple factors that I will be delving into over the course of this report, the opportunity has very little downside risk, whilst maintaining high-yielding returns.

The reasons why I am interested in selling Oil derives mainly from how unsustainable current prices are at this moment. We have seen a parabolic price run from negative prices to where we are now in the space of just two years.

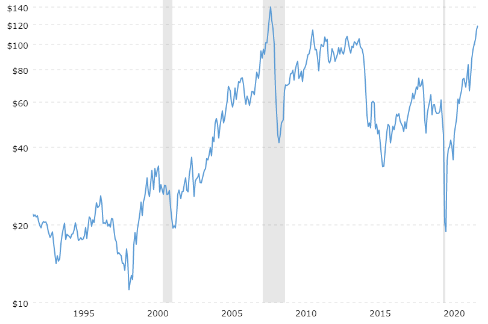

If we take a look at the price chart of WTI Crude Oil, we can see prices have rallied to the highest price level in 10 years.

We are currently sitting at just under $120 after the huge bull run post-oil going negative in 2020.

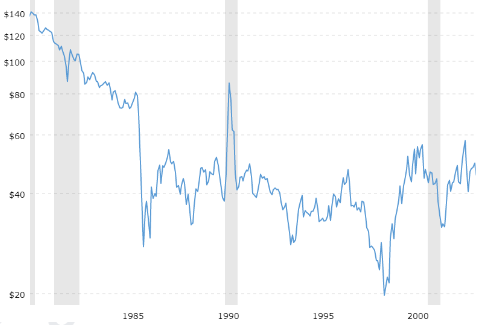

If we take a look at a 30-year chart, we can see that the highest price ever for WTI Crude Oil was $140 per barrel:

This was hit in June 2008, during The Great Recession. This was towards the start of the tipping point, where the house of cards fell down on the US Housing Market, sending the rest of the world into a freefalling financial recession.

Notice how the high in the oil prices marked the start of the economic collapse, and the low marked the end.

We are very close to this price now but have huge downward pressure to keep prices low.

OPEC

Now, the main reason behind this trade idea is the reaction of OPEC to the price extremes. It is not the high prices themselves that have given me this trade idea, it is the fundamental driving forces behind those high prices and the market sentiment that has given me this idea.

The Organisation of the Petroleum Exporting Countries is a collective of 15 different countries that govern the production and output of oil. The list includes; Algeria, Angola, Congo, Ecuador, Equatorial Guinea, Gabon, IR Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, and Venezuela.

Many included in the list, especially the likes of Saudi Arabia, are some of the most oil-dense nations with immense influence in the oil market. Therefore, the policies determined by OPEC are extremely dominant in determining the prices of oil in every product variety.

Due to the situation with Russia and Ukraine, oil production has not been able to keep up with demand. As a consequence, OPEC has agreed to ramp up output for July and August by 650,000 barrels per day, which is 50% more than previously planned.

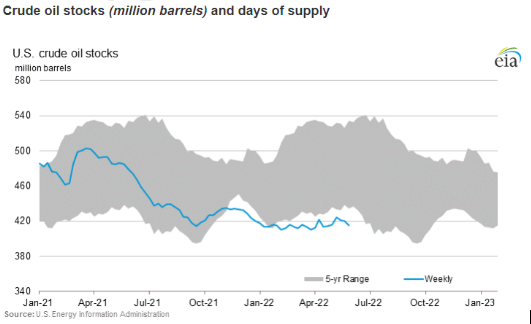

If you take a look at the figure below, you can see the additional output compared to the last five years for each month. This additional supply exceeds this range by a substantial amount.

This reaction is due to the huge outcry on a global scale on the price highs of Oil. The world is currently finding these prices unsustainably high. When you consider, although demand is very high at this moment, the production amount will be around the highest it has been in 5 years. During these last 5 years, the oil price has varied a lot but generally traded most of the time between $40-80 per barrel.

The price rises have been a huge influence on the inflation figures reported for economies across the world. The oil market plays a huge part in the inflation of a country. It plays a major role in the basket of goods that is selected for the reported figures. With inflation getting out of hand, policymakers will need to keep oil prices low to fight the rising rates.

As the Russian-Ukraine conflict is interfering with the supply of Oil, OPEC will have to continue producing large amounts of crude Oil for the global demand and to reduce high inflation. It is in all of these countries benefit to increase production.

Political Pressure

The next reason, which is linked to the high inflation, is the political pressure that is adding fuel to the fire. At this moment, the high inflation and high oil prices have led to tough times for the average person. Current governments will want to do everything they can to stop this from continuing.

Political systems, such as the Biden administration, have made it a priority to reduce oil consumption through swift mandates and policies. This may have to be reduced whilst the economy is so unstable. The next US mid-term election is due in November 2022, and the current administration will certainly be under question for the ongoing situation. It is in the US government’s interest to lower inflation as much as possible to provide stability for the nation. The most influential component of this is reducing the prices of Oil.

In fact, President Biden has indicated he is to meet with Saudi officials to discuss the circumstances. Although no date has been confirmed, the fact that the decision is in question shows just how problematic the situation has become. The oil partnership between the two nations has lasted nearly 80 years, so an agreement would be beneficial for both parties. It is integral to the entire prosperity of the US economy – which is a priority for Biden’s presidential hold.

Potential Recession

As the average person’s pocket gets stretched, the market appears to be on the eaves of a recession. It seems everyone in the financial industry has been talking about it, yet they are often not referring to Oil as a driving force behind this.

According to Bloomberg, “In the past 50 years, every time oil prices, adjusted for inflation, rose 50% above trend, a recession followed data from Luca Paolini, the chief strategist at Pictet.”

In the same article, they stated, “investors are currently questioning how long the strength in energy stocks will last, as the group is now the third-most shorted industry on the S&P 500, with short-sellers betting that the oil boom will soon be over.”

What is interesting is that it is not just that Oil tends to be a leading indicator of a recession, but it also follows the cycle.

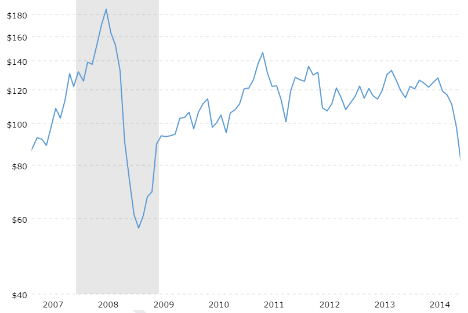

If we take a look at the price chart of crude Oil during the last recession in 2008, we can see that the high falls not far from the start of the recession, and the low falls not far from the end:

You can actually go through the chart and see that over the last 5 recessions (including the Coronavirus crash), the price of crude oil has dropped every single time. This has covered the last 40 years of the financial markets, which gives me additional confirmation of a drop lower.

Here is a chart showing, 2001, 2008, and 2020 market crashes:

And another for 1981-82 and 1990-91:

The only two times in the last almost 70+ years the oil prices have closed above where it was at the start of a recession were 1974-75 and 1980.

Using all of this information, we have not just a high probability of a recession, (we may already be in one but do not know it yet), but also a price drop in the oil market.

Trade Idea

Now that I have a strong indication of where the momentum is likely to head, I can look for a potential trade idea. I want to avoid shorting oil through a brokerage as the overnight holding fees can be extremely high. Therefore, I must ensure I am placing the position through an investment fund or ETF to prevent these fees from being applied.

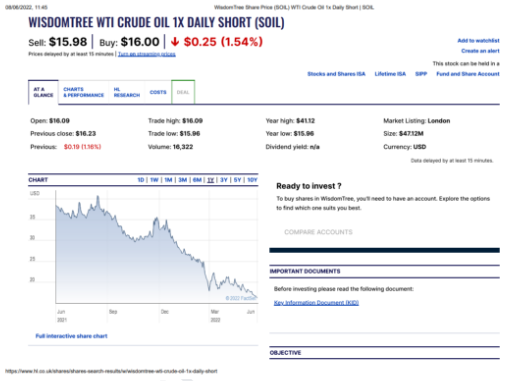

The first method to shorting the crude oil market effectively is through a WTI Crude Oil Short ETF. This is available on many brokerage platforms, such as Hargreaves Lansdown, which has a WisdomTree WTI Crude Oil 1X Daily Short available for purchase:

Remember that as the Oil prices have risen, the price of a shorting ETF will fall. This is the same for both.

This is a simple shorting position, where I will be looking for a price target of between $40-80 per barrel. From the current price of $120, this is anywhere from a 30-67% return. Rather than paying overnight holding fees, I will only pay a small commission charge for each side of the deal.

This is a relatively low-risk position as we have never reached above $140 per barrel. Because of this, there is another alternative trade idea.

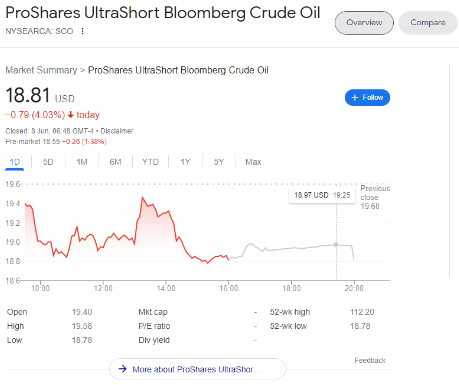

The position I will be putting on is through the SCO ETF. This is a ProShares Ultrashort Bloomberg Crude Oil Short ETF and is only available through a few different investment firms, such as Interactive Brokers.

This is a 2X leveraged position, tracking the crude oil market every day. As it is a leveraged short position through an ETF, my risk will be double that of the WisdomTree WTI Short ETF.

The reason that I am placing this trade as a 2X leveraged position is to further capture the move. I have strong confirmations supporting lower prices, leaving me with a limited risk amount. Therefore, by placing a leveraged ETF, I can keep my risk small but maximise my returns.

With the price of crude never in history surpassing $140 per barrel, my risk is still small. With an entry at $120, the price would have to exceed $180 per barrel for me to lose my entire position. This would be 30% higher than the highest in history and completely unsustainable for the global economy. However, if the price was to reach the $40-80 range, I would be achieving a 60-134% return.

If the price of oil was to hit $150, 7% over the all-time high, then the expected drawdown on the position would be 50%, giving the potential return extremely favourable.

WisdomTree would need to hit $240 per barrel for me to lose my entire position. By placing the leveraged position on SCO ETF, I am basically increasing my “lot size” and reducing my stop-loss to increase my gains.

Potential Issues

Although I cannot see any mid-term potential issues, I must fully understand what could go wrong before putting on a position. The two main reasons I could see prices rise beyond expectations are slightly linked with each other.

The first, and most likely, is that OPEC is unable to meet the output targets. Although they have made announcements for high production to meet the high supply, they may be unable to deliver on this. They may have the oil reserves, but the sheer demand may be fulfilled in time for the production duration, leading to greater price rises. The huge supply chains involved; production and distribution channels are global enterprises that are extremely intricate. The difficulty in meeting the output targets could be a promise they may not be able to pull off.

The second potential issue, which is linked to the first, is the introduction of China into the situation. The country’s oil consumption dropped upon national lockdowns, which are now being eased. A reopening of the Chinese economy could see demand for oil increase beyond the additional supply.

Conclusion

To conclude, the main reasons behind this position are political. The high oil prices and high inflation rates are now in the public eye, thus, a major concern for policymakers across the world. The price extremes cannot be sustainable for the world economy. They must be brought back down via government intervention to prevent civil unrest.

The Biden Administration will be faced with huge pressure from the US population, which is particularly important when we consider mid-term elections due later this year. They may be especially vulnerable if they are unable to put the fire out.

Then when we consider the announcements from OPEC to increase the supply beyond the five-year range, we can expect a higher probability of falling prices back inside the $80 average. Only a couple of times in the last 70+ years have we traded above $80.

Crude oil is a leading indicator of a potential recession, which is followed by a price drop. Although the price is highly volatile at this time, my position, in my opinion, is a low-risk one due to the fundamental driving forces behind the move.

I have given you the information for both potential trade ideas, which can be based on your own circumstances. I am going to be shorting crude oil by purchasing a 2X leveraged short ETF and holding to a price target of $40-80 per barrel.

Useful Links:

https://www.eia.gov/petroleum/weekly/crude.php

https://samuel-leach.medium.com/will-we-soon-see-us-crude-oil-back-at-100-a-barrel-6bc8b30c45b4

https://www.macrotrends.net/1369/crude-oil-price-history-chart